You can find any business articles, publications by keywords

My name is Alex Fit. I am a web specialist with over 15 years of solid professional experience. My area of expertise includes everything from website development, maintenance and support to the effective website promotion and advertisement.

Why should you choose me?

Popular Stories

Is Estate Planning is dead? Why or Why Not?

Apart from planning the fate of your assets after your demise, estate planning was also oriented towards saving your assets from the federal and state

Do I need an Estate Plan?

A question that pops up inside every adult’s mind is, “Do I need an estate plan?” A study reported that more than 76% of adults in the US think that having a will is good but only 46% of adults have one. You can see a large number of people are still avoiding estate planning even though they know the benefits it brings. However, if you are confused about having an estate plan for yourself then we will try to explain why you need it. First of all, you need to forget the myth, “Estate planning is only for rich people” because it isn’t. We have seen a report which suggested that young people or the millennial’s are being attracted

Best Estate Planning Lawyers in Brooklyn: Why it is important?

Estate Planning is something that we often ignore because we don’t find it necessary. There is even, a survey which says that only 4 out of 10 Americans currently have an estate plan which refers to the fact that a lot of people are ignoring the importance of Estate Planning. Believe it, everyone including people who own a car, have furniture, own a home, have saving accounts, possess life insurance, and have a few investments should think about Estate Planning. If you have already thought about it then in that case, an Estate Planning Lawyer in Brooklyn can come in handy. Estate Planning Brooklyn It doesn’t matter if you have modest or large property Estate Planning is required. Let’s say

Best Option – Zoom Whitening in Brooklyn

You’ve tried over-the-counter whitening strips and they didn’t work as well as you had hoped. Perhaps some years ago, you tried an in-office whitening procedure, and it too, didn’t give you the results you were looking for. You’re a Brooklyn resident, and your smile is important to your work, your social life, and your self-esteem. You’ve heard about zoom whitening in Brooklyn, but you’re not sure which dental practice is the best to provide this innovative new technology. What Is Zoom Whitening Procedure Zoom whitening is an in-office dental whitening procedure in which an aggressive bleaching compound and a light applied 3-4 times during the course of an hour whiten your teeth, ridding them of stains. Results can vary based on the

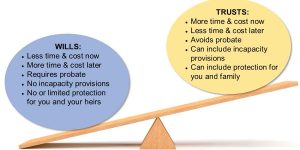

Should you set up a revocable living trust?

While getting older people do think of their retirement and plan accordingly, however, they avoid planning their estate which is equally important during and after their life. While having a proper retirement plan helps you to plan your choice of life after your retirement, the estate planning helps you to manage and secure your family and assets during and after your life. Estate Planning- Estate planning is equally important for everyone irrespective of your age and wealth, however, every individual needs different estate plan accordingly and it should be thought and implemented carefully after discussing with an estate planner. Though most people think of drafting a will, however, if you are worried about how the beneficiaries will handle their share

How to do Estate Planning for Separated Spouse?

It is always suggested planning your estate as early as possible and it becomes more important if you have children. You might have planned everything carefully be it distribution of your property, guardianship for your minor children, insurance policies, etc. but you haven’t thought of divorce as you never know what life brings in for you. If you are getting divorced due to any reason you will be facing emotional and financial turbulence. In such a situation you will have to work out so many things, make several decisions and in between all those stuff, you forget about estate planning. However, after a divorce, it is essential to update your estate plan as now your priorities, beneficiaries, and goals might